Galveston title loans offer quick cash using your vehicle's title as collateral, providing an accessible alternative for emergency funding without perfect credit. The straightforward process involves basic requirements and swift approval. To maximize benefits, maintain vehicle equity, keep the car in good condition, and consider it for emergencies or large purchases, as these loans may offer better terms than traditional personal loans.

Galveston title loans offer a streamlined borrowing solution for residents seeking quick cash. If you’re new to this process, understanding the basics and navigating the application steps is crucial. This article guides beginners through the entire journey of Galveston title loans, from grasping the core concepts to mastering the simplified application process. By following tips on maximizing loan value, you can ensure a successful experience.

- Understanding Galveston Title Loans: Basics Explained

- Step-by-Step Application Process Unveiled

- Maximizing Loan Value: Tips for Success

Understanding Galveston Title Loans: Basics Explained

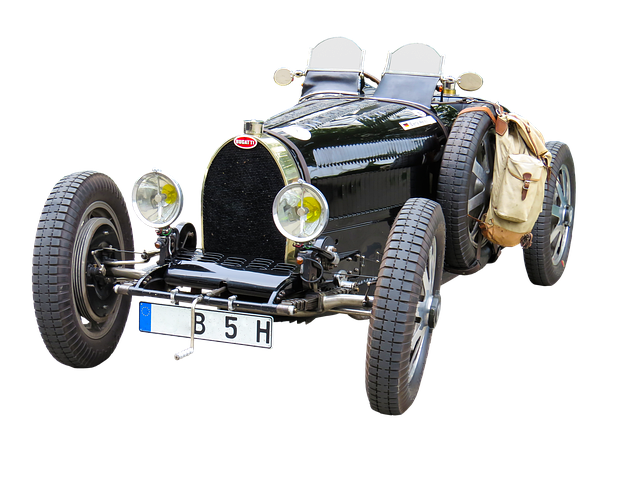

Galveston title loans offer a unique way to access emergency funding by using your vehicle’s title as collateral. This type of loan is designed for individuals who need quick cash and don’t have perfect credit. It’s an alternative financing option, especially in situations where traditional bank loans or San Antonio loans might be difficult to obtain. The process involves a simple application and evaluation of your vehicle’s value, making it accessible for those seeking immediate financial assistance.

Unlike Boat Title Loans, which are secured by watercraft, Galveston title loans utilize your car’s title, ensuring that the lender has security. This allows borrowers to keep their vehicles while accessing funds. The application process is straightforward, requiring basic information and documentation. Once approved, you can receive your emergency funding quickly, providing relief during unexpected financial emergencies.

Step-by-Step Application Process Unveiled

Applying for a Galveston title loan is a straightforward process designed to provide borrowers with a quick and accessible financial solution. It’s an ideal option for those needing a cash advance, whether for an unexpected expense or a planned purchase. The first step involves gathering essential documents, including your vehicle’s registration and proof of insurance. This ensures the lender can securely verify your ownership and assess the value of your vehicle.

Next, complete the online application form, providing details about your vehicle and personal information. This is where you’ll disclose the intended use of the loan funds. Once submitted, a representative will review your application and, if approved, contact you to discuss loan payoff options. The process aims to be efficient, with a focus on getting you the approval and cash advance you need as quickly as possible, while ensuring a transparent and fair transaction for all Galveston title loan applicants.

Maximizing Loan Value: Tips for Success

When applying for Galveston title loans, maximizing your loan value is key to getting the most out of this financial solution. One effective strategy is to ensure you have significant vehicle equity. This means maintaining a low debt-to-value ratio on your vehicle, which can significantly boost your loan amount. Keep your car in good condition and stay current on maintenance to maximize its worth.

Additionally, consider using Galveston title loans not just for large purchases but also as a strategic way to access emergency funds. Since these loans are secured by the value of your vehicle, they offer a convenient source of quick cash during financial emergencies. Even if you have excellent credit, boat title loans or other types of collateralized financing might provide better terms and rates compared to traditional personal loans.

For those new to the concept of Galveston title loans, this guide has demystified the process, from understanding the basics to applying efficiently. By following the step-by-step instructions and maximizing loan value tips, you can secure the financial support you need with relative ease. Remember, when it comes to Galveston title loans, knowledge is power—empowering you to make informed decisions about your short-term borrowing needs.