Galveston title loans offer Houston residents a quick, accessible way to gain capital using their vehicle's equity as collateral, with flexible terms, no credit check, and a straightforward process. To apply, gather essential documents like ID, proof of residency, income evidence, and clear vehicle title or recent bank statements for assessment. Organize financial details to understand repayment options and streamline the application for these game-changing Galveston title loans.

“Exploring Galveston Title Loans: Your Path to Rapid Financial Support

In today’s fast-paced world, accessing immediate funding is crucial. Galveston title loans offer a unique solution, providing quick capital with minimal hassle. This comprehensive guide navigates your journey, from understanding this secure lending option to mastering the application process.

We’ve crafted this article to ensure a seamless experience. It includes an in-depth look at the required documents, offering valuable tips for preparing everything needed to maximize your loan potential.”

- Understanding Galveston Title Loans: Unlocking Access to Quick Capital

- The Application Process: Document Checklist for a Seamless Experience

- Maximizing Your Loan Potential: Tips for Gathering Essential Papers

Understanding Galveston Title Loans: Unlocking Access to Quick Capital

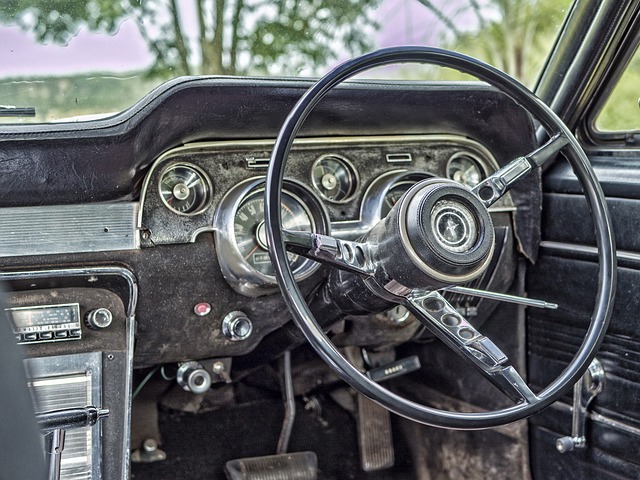

Galveston title loans offer a unique and accessible way for individuals to gain quick capital when they need it most. This type of loan is secured by the title of a vehicle, providing a fast and efficient alternative to traditional bank loans. By using your car’s equity as collateral, you can unlock funds without the stringent requirements often associated with other loan options. This makes Galveston title loans an attractive choice for those in Houston or surrounding areas who require immediate financial support.

With flexible loan terms and the convenience of a no credit check policy, these loans are designed to accommodate various financial situations. The process is straightforward; you simply provide your vehicle’s title as security and agree on a repayment plan that suits your needs. This arrangement ensures that both parties are protected, allowing for a mutually beneficial transaction. Whether it’s an unexpected expense or a chance investment, Galveston title loans can be a game-changer, providing access to capital in a swift and efficient manner.

The Application Process: Document Checklist for a Seamless Experience

When applying for Galveston title loans, having a clear understanding of the required documents is key to a seamless experience. The process involves submitting several pieces of information to establish your eligibility and secure the loan. This checklist ensures that you have all your affairs in order, making the application smooth and efficient.

Start by gathering essential identification documents like a valid driver’s license or state ID card. Additionally, proof of residency is necessary, which can be in the form of a utility bill or lease agreement. For Galveston title loans, it’s crucial to demonstrate both your identity and your connection to the community. Furthermore, you’ll need to provide evidence of income, such as pay stubs or bank statements, to ensure repayment capability. If considering loan refinancing or a title pawn, having a clear title for your asset is paramount, enabling a straightforward title transfer process.

Maximizing Your Loan Potential: Tips for Gathering Essential Papers

When applying for Galveston title loans, having all your essential documents ready can significantly maximize your loan potential. Lenders will want to assess the value of your asset—typically your vehicle—and your ability to repay the loan. Gather important papers such as proof of ownership for the vehicle, which could be a registration document or a title certificate. Additionally, ensure you provide recent financial statements, like bank statements, to demonstrate your repayment capacity and existing financial obligations.

To prepare for the application process, organize documents related to your employment status, including pay stubs or tax returns, as these will verify your income. It’s also beneficial to collect information about any existing loans or debts you have, along with their associated interest rates and repayment terms (including Houston title loans if applicable). Understanding your current financial situation will help when exploring different repayment options for your Galveston title loan.

Galveston title loans can provide a quick and accessible solution for those in need of capital. By understanding the application process and ensuring you have all the necessary documents, you can streamline your loan request. Whether it’s for an emergency or a planned investment, having a clear checklist ensures a smooth experience. Maximize your loan potential by gathering essential papers promptly, allowing you to unlock the financial support you need in no time.