Galveston title loans offer secured financing using vehicle titles as collateral. With flexible terms tailored to credit history and income, these loans cater to individuals with poor credit or limited income. Prospective borrowers must own a clear-titled vehicle, be at least 18 with stable income, and provide valid ID. Transparency is key during the application process. Post-approval, borrowers should review loan agreements, create a repayment plan, set up automatic payments, and manage their budget to ensure successful loan navigation.

First-time Galveston title loan borrowers can navigate this secure lending option with expert guidance. Understanding Galveston title loans starts with knowing their basics and eligibility criteria. This article breaks down the fundamentals, who qualifies, and crucial steps after approval. By following these tips, you’ll be well on your way to securing a Galveston title loan confidently.

- Understanding Galveston Title Loans: Basics Explained

- Eligibility Criteria: Who Qualifies for a Loan?

- Securing Your Loan: Steps to Follow After Approval

Understanding Galveston Title Loans: Basics Explained

Galveston title loans are a type of secured lending that uses a property’s title as collateral. This means if you can’t repay your loan according to agreed terms, the lender has the right to take over ownership of your asset. Typically, this involves vehicles, real estate, or valuable personal property. The process starts with assessing the value of the asset and determining a loan-to-value ratio. Lenders then offer a loan amount based on this assessment, considering factors like your credit history and income.

Unlike traditional loans, Galveston title loans often have flexible terms and payment plans tailored to borrowers’ needs. They are designed for people who may not qualify for conventional loans due to poor credit or limited income. The payoff process involves either paying off the loan in full or negotiating a new agreement with the lender. It’s crucial for borrowers to understand the terms, including interest rates, fees, and potential consequences of defaulting on the loan, before securing a Galveston title loan.

Eligibility Criteria: Who Qualifies for a Loan?

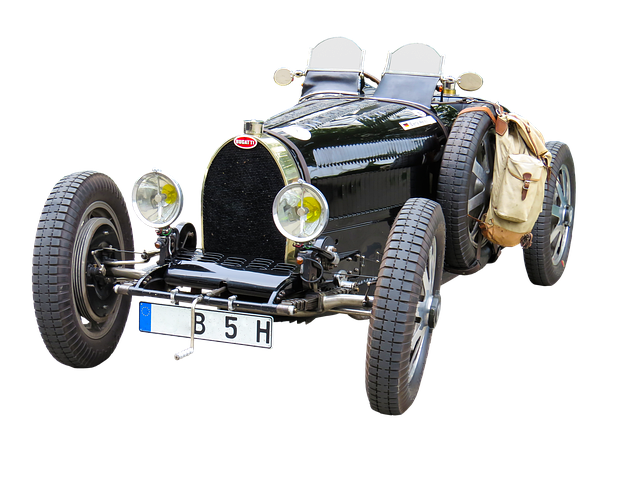

In the case of Galveston title loans, understanding the eligibility criteria is key for prospective borrowers. To qualify for such a loan, applicants must first own a vehicle with a clear and marketable title. This includes cars, trucks, SUVs, and even motorcycles, making motorcycle title loans a viable option for those in need. The lender will assess the vehicle’s value to determine the maximum loan amount available.

Additionally, borrowers should meet basic requirements such as being at least 18 years old, having a stable source of income, and providing valid identification. While keeping your vehicle is a significant advantage, it’s not the sole determinant of eligibility. Lenders will conduct thorough checks to ensure the accuracy of the provided information, so transparency and honesty are crucial steps in the loan application process.

Securing Your Loan: Steps to Follow After Approval

After securing approval for a Galveston title loan, it’s crucial to follow certain steps to ensure everything goes smoothly. Firstly, review your loan agreement carefully. Understand the terms, interest rates, and repayment schedule as outlined in the document. This is your legal contract, and clarity now can save you from surprises later. Next, decide on how you’ll use the funds. Given that these loans are typically for short-term financial assistance or debt consolidation, having a clear plan is essential. You might opt for Houston title loans if you need more extensive financial support, but for Galveston residents, focusing on debt relief or covering immediate expenses could be the primary goal.

Once your strategy is in place, set up automatic payments if possible to avoid late fees. Many lenders offer this service, ensuring timely repayments. Lastly, consider building a budget that accounts for both your loan repayments and any other financial commitments. This proactive approach will help you manage your finances effectively, especially as you navigate the world of Galveston title loans or explore alternative solutions like Houston title loans for future needs.

Galveston title loans can be a powerful financial tool for those in need of quick cash. By understanding the basics, knowing the eligibility criteria, and following the secure loan steps outlined in this guide, first-time borrowers can make informed decisions and access much-needed funds with confidence. Remember, when considering a Galveston title loan, it’s crucial to do your research and choose a reputable lender to ensure a positive borrowing experience.